February 6, 2012

Pie charts aren't always evil. A confession of a hypocrite.

Let me set the record straight. I HATE pie charts. I’ve written about and critiqued them many, many times. But I must confess…I used them in a presentation to a customer last week.

Yes, I am a hypocrite and I realized that immediate after I created them. So why did I use them? We had a meeting two weeks ago in which people in my same role shared event optimization success stories for their customers. We were presented some compelling results that included what I found at the time to be a straight forward pie chart used in the proper context.

For a little context, Stephen Few says in his article “Save the Pies for Dessert”:

Pie charts are not without their strengths. The primary strength of a pie chart is the fact that the message “part-to-whole relationship” is built right into it in an obvious way.

Stephen continues by declaring how bar charts can accomplish this a well.

A bar graph doesn’t have this obvious purpose built into its design. Not as directly, anyway, but it can be built into bar graphs in a way that prompts people to think in terms of a whole and its parts. This can be accomplished in part by using a percentage scale.

Let’s take a deeper dive into what I created.

The primary message I wanted to communicate was the year over year contribution of each promotional type to the total sales. Why do I think this works?

- The parts-to-whole relationship is intuitive

- There are only three colors, which makes remembering what they represent easy

- The slices are in order by promotional depth (i.e., the depth of the discount)

- You can quickly scan your eyes left to right to make the comparisons

According to the buyer I was presenting to, this was easy to understand and clearly showed that promotional depth has shifted from P2 to P1, indicating less frequent deep discounts.

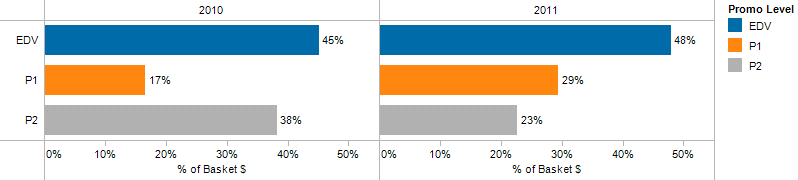

But then I got thinking, how else could I have presented this data. Below are several alternatives starting tart with a simple bar chart.

For me, this layout makes the year over year comparisons more difficult. I feel like I get distracted by the bars that are in between the bars I want to compare.

Perhaps reorganizing the bars so that they are year over year within each promo level will help.

This layout works well. The year over year comparisons are much quicker in this format. However, I’ve lost the parts-to-whole relationship.

Maybe making the bars side by side horizontally will help.

The side by side bars make for easy year over year comparisons. But this layout struggles to easily communicate the contribution of each promo level to the yearly total without much explanation.

Line charts communicate year over year well. Maybe those will work.

I created two line chart options, one with labels and one without. Yes, the year over year comparisons are incredibly simple, but I hate them both for two reasons.

- The parts to whole relationship is totally missing, which is core to the message I’m trying to communicate

- There is way too much white space

That leaves us with two more options. First, an area chart.

This area chart might be a good alternative because it combines both a line chart and a stacked bar. It’s too geometric for me though.

We’re left with one final option…a stacked bar chart.

A stacked bar is the obvious competitor to the pie chart. Honestly, I wish I had chosen this chart type. It communicates all of the same information as the pie chart, but in a cleaner layout. The year over year comparisons are a bit easier because the colors are closer together.

Can I promise I’ll never use pie charts again? Never is too strong of a word. But after going through this exercise and looking at all of the alternatives available, I’m confident that I’ll be relying on my old friend the stacked bar chart.

Hey Andy,

ReplyDeleteI too admittedly find myself to be a hypocrite in this occasionally.

If the results are very binary, the pie can be a reasonable medium for providing that "part to whole" understanding.

I still strongly believe that we should avoid the use of pies in period over period comparisons.

Good post to allow people various perspectives.

Thank you for this post. I have been compelled to use pie charts at work but only because that is what people are used to and ask for. Though I only use them when I have a manageable number of categories and the pie charts are not ugly and confusing.

ReplyDeleteI agree with your use of the stacked bar chart using percentages. In your specific example, however, you only have two years. Very easy to compare visually the two years. However, what happens when you have more than two or three years/categories to look at? A stacked bar chart with 3 or more segments with more than 3 years can be visually overwhelming.

Perhaps use a stacked area chart? I find those confusing as heck though.

Robert,

ReplyDeleteIf I can be frank, I don't like the old "it's what people are used to argument". I have found that once you display the data more effectively, people turn the corner. Don't give up.

If you have multiple years, but still need to display a parts to show relationship, I like the stacked bar/area chart option because it gives you both the % of total and the trend. I agree that a regular stacked bar would be too confusing.

I can duplicate all of the charts in this post across months if that would help you.

Ultimately, keep it as clean as possible and look at all of the alternatives before coming to a final decision.

Well, I hate pie charts too, but I once did about 260 of them on one visual, and found it actually worked together in what I'd call Charting Serendipity!

ReplyDeletehttp://jonboeckenstedt.wordpress.com/2012/01/18/data-visualization-serendipity/

I love it Jon!

ReplyDeleteHi Andy,

ReplyDeleteThanks - laying out the different options for visualizing this mix change over time is helpful.

I, too, use pie charts from time to time (cue Pachelbel's Canon) but preferred your stack-bar chart example at the end of the post. It's easier to see the magnitude of the % change of EDV, for example, with bars than it is with pie wedges.

The stacked area chart and the line charts give the impression that the changes in the three categories occurred steadily and in a linear fashion over time, as if you were graphing monthly figures, which could be misleading, so I would vote against these as you do in your post.

Thanks again, and about your hypocrisy, just remember - you're in good company. In the words of Doc Holliday, "It appears my hypocrisy knows no bounds."

Talk to you soon,

Ben

Andy,

ReplyDeleteThanks for encouragement. I will go back to some of the dashboards I have been working on and take a look to see how a stack bar chart by percentage would look instead of a pie chart.

I might play around with the stacked area chart as well now that Tableau offers that as an option.

Thanks again for your blogging.

I've found the best reason for using a pie chart is when there is a need to obfuscate the relationship.

ReplyDeleteIn one case, pie charts were chosen so that the speaker could use the pie chart as a reminder of topics to discuss. In this case, the purpose was to show data relationships, but rather to engender discussion about a topic without focusing on exactly how much bigger/smaller one segment was to another.

While this could have been done with just a list of topics to cover, but the more colorful pie chart generated more desirable discussion.

Timely topic Andy - I actually used 4 pie charts in a presentation to a customer last week - first time for years.

ReplyDeleteThey worked well, and exact percentages were less than important - just the ratios.

Still felt a little dirty though.